COVID-19 IMPACT

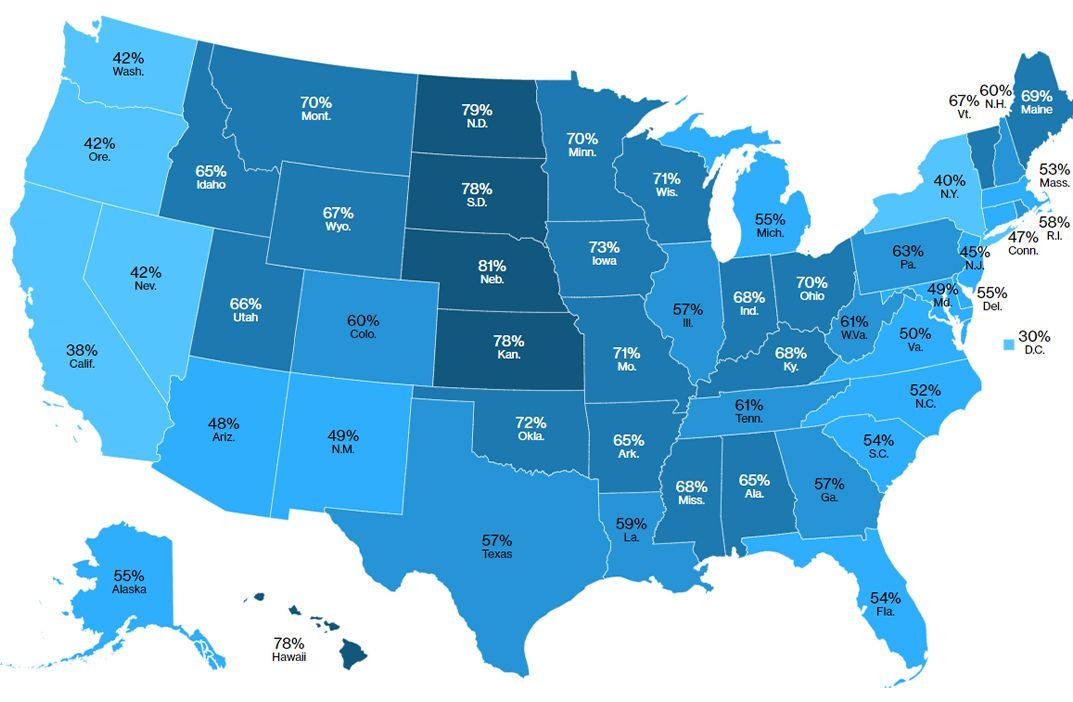

During the first 13 days of the federal government’s small-business rescue program, the amount of approved loans varied widely state by state. Many of the largest states in the US had the smallest percentages of approvals as a percentage of eligible payroll,while states such as Nebraska were able to get 80.7% of their loans approved.

There are many speculations as to why this is the case, but many people believe that smaller, community banks in the Central United States were more willing to help customers in their time of need. Many large institutional banks were overwhelmed by the sheer number of customers that were in need of assistance. This could prove that smaller, customer focused banks could be a real asset to companies going forward.